‘…the CBN’s recent pronouncement on the MPR has both positive and negative implications for Nigeria’s fragile economy. While raising MPR could help reduce inflation, it could also make it difficult for business to access credit and for economy to attract foreign investment. The CBN will need to carefully balance these competing interests in order to promote economic growth and stability in Nigeria’

Meaning of MPR and how it is used in controlling money supply

THE MPR (Monetary Policy Rate) is the benchmark interest rate used by Financial Institutions to determine lending rates. When CBN increases the MPR, it becomes more expensive for individual and corporates to borrow from financial institutions and this will in turn slow down productive activities. This makes it more expensive for business and individuals to borrow money, reducing the level of investment and consumption in the economy.

CBN’S role in using monetary policy (and other controls) to control inflation

When prices of goods and services in an economy deviate from the target set and inflation heats up, the Central Bank of Nigeria (CBN) can use monetary policy to try and restore that target. They can raise interest rates or restrict the money supply which are both contractionary monetary policies designed to lower inflation.

On the other hand, to reduce inflation, the government can increase taxes (such as Income Tax and VAT) and cut spending. This also helps to reduce demand for goods and services in the economy.

The implications for the Nigerian economy

The pronouncement by Central Bank of Nigeria (CBN) regarding the Monetary Policy Rate (MPR), has significant implications for Nigeria’s fragile economy. With the pronouncement of an increase in the MPR from 17.5% to 18% by the governor of CBN, Godwin Emefiele, Nigeria now has the highest interest rate more than, both the most rapidly developing countries (or emerging economies)-BRICS and BRIC successors (countries whose market are becoming potentially some of the world’s largest economy). (https://www.premiumtimesng.com/news/headlines/589411- cbn-increases-benchmark-interest-rate-to-18.html)

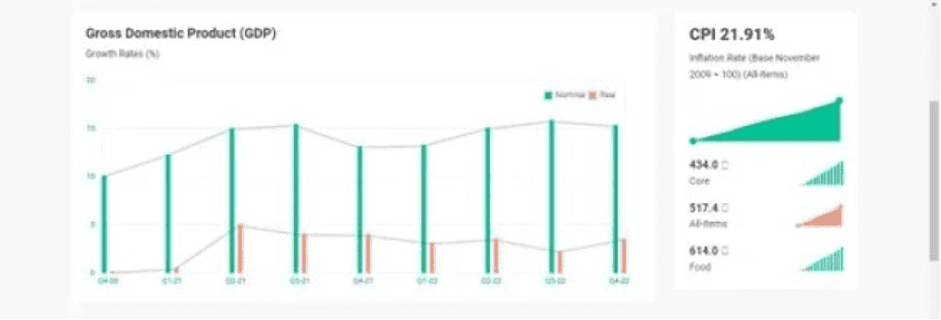

Nigeria’s inflation rate recently rose to 21.91 percent in February 2023, from 21.82 percent in the previous month.

Image credit: https://www.nigerianstat.gov.ng/

Also, following the CBN’s Naira redesign policy, currency in circulation has dropped from ₦3.28 trillion in December 2022 to ₦1.38 trillion in January 2022 and to an estimated ₦982.09 billion in February 2023, representing a 235 percent decline in the available cash in circulation. (https://www.dataphyte.com/latest-reports/development/nigerias-currency-in-circulation-is- lowest-in-15-years/)

It was expected that the scarcity of redesigned notes, which caused a cash crunch in the economy, since January 2023, would stimulate a slowdown in demand-pull inflation, especially, given the series of interest rate hikes, from the Central Bank of Nigeria. This has however not happened yet.

The move by The Central Bank of Nigeria (CBN) has both positive and negative implications for the Nigerian economy. On the positive side, raising the MPR could help reduce inflation, which has been a major problem in Nigeria for several years. High inflation erodes the purchasing power of consumers, discourages savings, and makes it difficult for business to plan and invest. By increasing the MPR, the CBN hopes to reduce the amount of money in circulation, which could help to bring down inflation.

However, there are also negative implications of the CBN’s pronouncement. Nigeria’s economy is still fragile, and the post-COVID-19 impact has further exacerbated existing economic challenges. Raising the MPR could make it more difficult for business to access credit, which could stifle investment and economic growth. Many businesses in Nigeria are already struggling due to the post-Covid impact, increasing the cost of borrowing could exacerbate the problem.

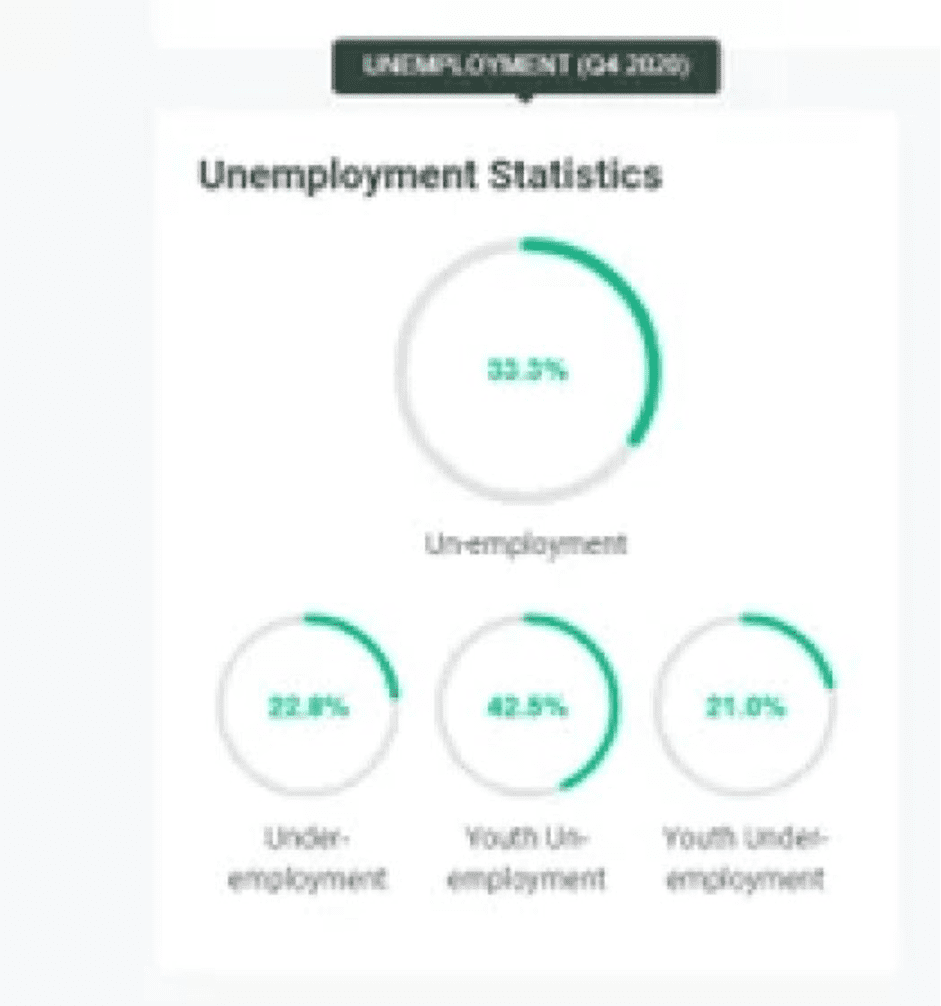

Image credit: Proshare

Furthermore, policy measures targeted at controlling spending, may not be the most preferable strategy for controlling current inflation trends. Cost-push factors are likely to remain the clear and present determinant of the direction of inflation. These include structural issues, which impact domestic food production and transportation, such as insecurity, floods in key agricultural producing areas, exchange rate challenges and rising international food and energy prices, following the Russian-Ukraine crisis.

However, the expected fuel subsidy removal is expected to keep pressure on domestic prices in 2023 in the course of the year.

In conclusion, the CBN’s recent pronouncement on the MPR has both positive and negative implications for Nigeria’s fragile economy. While raising MPR could help reduce inflation, it could also make it difficult for business to access credit and for economy to attract foreign investment. The CBN will need to carefully balance these competing interests in order to promote economic growth and stability in Nigeria.

Sir Gbenga Badejo FCA, KJW is the Managing Partner/CEO of GBC Professional Services; and Gbenga Badejo & Co (Chartered Accountants & Tax Practitioners), a correspondent firm of Reanda International, which is an international network of Independent Accounting and Consulting Firms with 41-member firms and over 250 partners with 4,500 staffing in 147 locations across the globe, including Asia Africa, Middle East and Europe

Comments are closed.